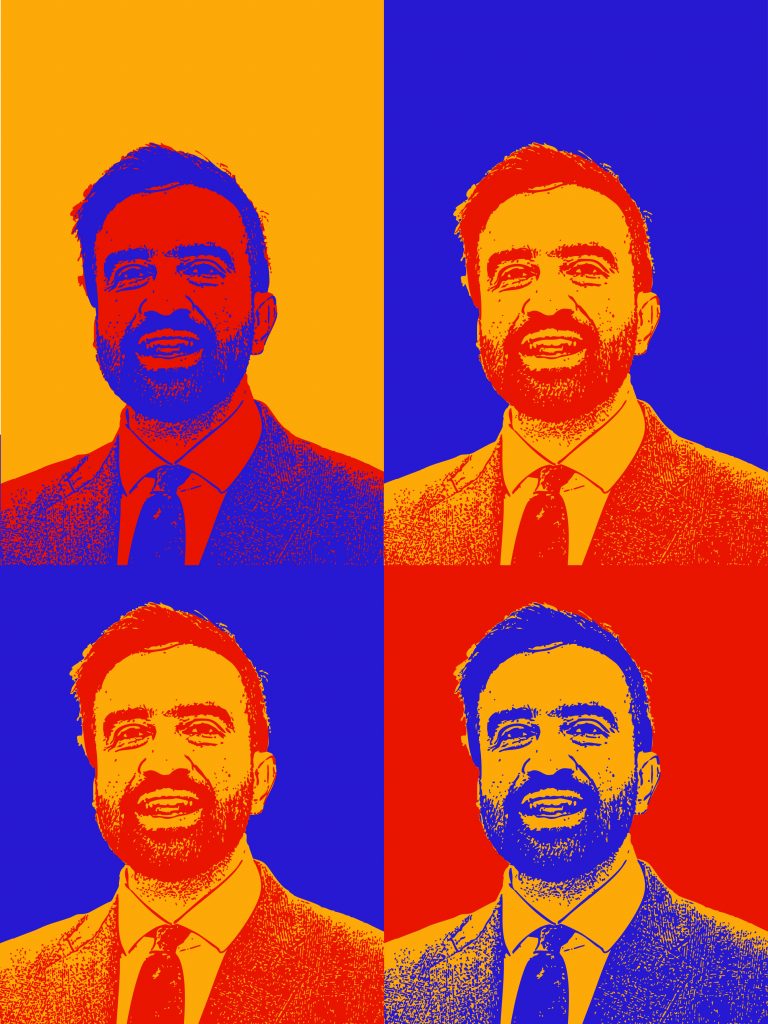

After a shocking Democratic primary in June, underdog Zohran Mamdani handily beat Andrew Cuomo, former New York Governor and predicted frontrunner. In November, the two will face each other again in the general election, but with Mamdani running as the Democratic candidate and Cuomo as an independent. Mayor Eric Adams is also seeking reelection as an independent, and Curtis Sliwa has the Republican nomination. The lead up to this election has felt like being held in a waiting room, on the brink of change. Rents are at all-time highs and vacancy rates are at all time lows. The Trump administration has brought national political upheaval sending in troops to Los Angels and Washington D.C. and threatening to do the same in New York City, Chicago and Boston. Democrats have been scrambling to find an inspiring, mobilizing leader, and they have turned their gaze to Mamdani.

Could Fiorello La Guardia be the blueprint for Zohran Mamdani?

A man, seemingly everywhere at once, ran for New York City mayor on bold reforms, the promise of workers’ rights and an end to corruption. His charisma and linguistic skills inspired first-time voters to cast their ballots. Referring to himself sometimes as a socialist, he was a communist to his opponents who tried to use red scare-like rhetoric to bring him down.

No, I’m not talking about Zohran Mamdani. I’m talking about Fiorello La Guardia – the 99th mayor of New York City from 1934-1945. He has been hailed by The New York Times as one of America’s all-time greatest mayors.

While some speculate if Mamdani will be able to deliver on his campaign promises that have become household-known – I oscillate between optimism and cynicism myself – history has shown that a similar candidate once did.

Fiorello La Guardia was born of Italian parents, his father Catholic and his mother Jewish. He was a first-generation American and an observant, not confirmed Episcopalian. His upbringing, defined by a mix of religious and ethnic identities, led him to the realization that what is most important about someone is their ethical disposition.

At the time, Italians and Jews were marginalized, despite how intrinsically New York Italian and Jewish diasporas are in today’s New York City. But during La Guardia’s political ascension, immigrants who came to New York earlier from Northern and Western Europe looked down upon the newer Italians and Jews and felt threatened by their growing numbers, discriminating against them in response.

La Guardia didn’t hide his background and was awarded for his pride, Italian and Jewish immigrants who had never voted before changed their ways for one of their own.

La Guardia succeeded John P. O’Brien, a democratic who was mayor for just one year. O’Brien was heavily backed by Tammany Hall, the democratic political machine in the city. Either too blase or stupid to try and hide who was pulling the strings while he was in office, O’Brien famously replied during a press conference, “I don’t know. They haven’t told me yet.” When asked who his police commissioner would be.

Jimmy Walker, another human embodiment of Tammany Hall, preceded O’Brien as New York City mayor and was forced to resign after corruption scandals. Walker was a Gatsby-like figure – extravagant, charming and overindulgent – he prioritized his social life over his role as mayor, notoriously not showing up anywhere before noon and accumulating hundreds of thousands of dollars as mayor that he couldn’t explain. He gave government jobs to his friends that they were paid for but never showed up to, he accepted bribes and often took vacations while serving as mayor.

Sound anything like the mayor Zohran could succeed?

La Guardia’s first run for mayor in 1929 ended in defeat, but just five years later as the average New Yorkers’ life was only getting worse due to the effects of the Great Depression, the route to the mayor’s office was paved for a working man’s champion like La Guardia to run a campaign on cleaning up corruption and improving the daily lives of New Yorkers. He won by a landslide.

Once in office, La Guardia presided over the construction of nearly 200 playgrounds, thousands of units of public housing, roads, bridges, and updated mass transit. All of these projects created desperately needed jobs. He expanded social services. “The Interests” was his nickname for big corporations, against whom he vehemently defended the working man. He hated social injustice, racism, corruption, and ignorance, and his strong sense of morality defined him as a leader. He appealed to both the underprivileged and the elite.

Mamdani – who won in the primary by the most votes since David Dinkins ran against Ed Koch in 1989 – had a similarly broad coalition. Conservatives blame transplant elites for Mamdani’s win, but New York City historian Asad Dandia says that’s a myth.

“He did win the votes of young professionals who might come from middle class communities in the suburbs or upper middle-class communities, but he also won the votes of working class and everyday middle-class locals,” Dandia said in a phone interview. “Look at, for example, Pakistani Brighton Beach, Chinese Sunset Park, Bengali Ozone Park, Dominican Washington Heights, Black Harlem, Latino Jackson Heights – these are all longstanding immigrant ethnic local communities.”

Before running for mayor, La Guardia represented two different congressional districts in the House of Representatives. While he represented the 14th District (Greenwich Village) from 1917-1919, La Guardia voted in favor of U.S. entry into World War I. He told his constituents he wouldn’t support a draft for young men without joining them – and stayed true to his word. La Guardia enlisted in the army, served in the Army Air Corps, and took a leave from his position as congressman, striking a deal to retain his seat.

As a state assemblymember for Astoria, Mamdani similarly showed his willingness to walk the walk when he participated in a 15-day hunger strike with the New York Taxi Drivers Alliance. When taxi drivers faced debt from predatory loan practices so crippling that eight drivers committed suicide in 2018, Mamdani fasted alongside drivers to pressure the city into reaching a deal to reduce and restructure the loans with the loan management investment firm.

La Guardia was a polyglot, using his fluency in English, Italian, German, Croatian, and Yiddish, to reach voters in their native language. Mamdani also utilized the power of multilingualism in his campaign to talk to different groups of New Yorkers. Mamdani’s clear messaging has made his campaign accessible in a way other democrats haven’t been able to do. There’s even been some overlap of Trump and Mamdani voters for perhaps this very reason – both claim to solve the problems of the working-class person over the ruling elite.

Dandia has noticed this trend too, of people not necessarily wedded to the republican or democratic party but looking for a candidate who can help make their lives better.

“They’re interested in anyone who speaks to their immediate needs and concerns, and that could be a snake-oil salesman like Trump, but at least they’re acknowledging people’s immediate needs and concerns, and that’s really what matters to these voters,” Dandia said.

Mamdani, who was largely unknown a year ago, spoke to New Yorkers in Hindi, Urdu, and Spanish, which undoubtedly helped propel him from oblivion into being one of the most famous democratic politicians in the country. Approximately 2.5 million New Yorkers have limited ability to communicate in English, and to many of them, Mamdani showed they are not forgotten.

La Guardia is proof that a socialist mayor will not destroy New York City. Despite some of the uncanny similarities that led to the rise of him and Mamdani, Mamdani will be faced with unique challenges. One of the reasons why La Guardia’s mayoralty was so successful was thanks to a supportive president in the white house, FDR. Despite being of different political parties, the two both saw the need for government intervention in social services and infrastructure and a pathway to relieving the American people from the economic hardship of the Great Depression. Trump, thus far, has not seemed willing to work with Mamdani, questioning his citizenship status and even threatening to arrest him.

Top Democrats in the state, much to their shame, including Governor Kathy Hochul, Senate Minority Leader Chuck Schumer, and House Minority Leader Hakeem Jeffries, have all withheld endorsements of their own party’s candidate. While this might seem like another challenge for Mamdani, it is also proof that like La Guardia, he is unbought from the party establishment.

Charles McBryde, human rights advocate and documentary filmmaker with 93.7K followers on Instagram, posted a reel comparing La Guardia and Mamdani, reminding New Yorkers that last time they elected a socialist mayor, the lives of New Yorkers were significantly improved.

In an online interview, McBryde talks about the conditions which have led to a figure like Zohran emerging with such popularity. According to McBryde, many Americans feel like the idea of the American Dream was never really an option for them – and the left, and right, are frustrated with the neoliberals in the center (take Joe Biden, Hillary Clinton, etc.) and their failure to bring good outcomes for most Americans.

“It feels like a repeat of the conditions that led to the Great Depression and the New Deal,” McBryde says. “When this falls apart around people’s heads, they’re going to be looking for alternatives. And Zohran is an early example if he’s saying, hey, I’m charting a different path. And that’s the exact position that LaGuardia was in almost a hundred years ago.”

McBryde also points out how interesting it is to have Trump elected and Mamdani (almost) elected within less than a year of each other. He sees this as a testament to Americans being over establishment, centrist politics.

“The only two things that those share in common is the fact that the American people are done with neoliberal centrist politics,” he says.

Mamdani openly cites La Guardia as a political inspiration. In an interview with The New York Times, when asked “Who was the best New York City mayor in your lifetime?” Mamdani responded, “In my lifetime? Bill de Blasio. All time? Fiorello La Guardia. His nickname was also Little Flower, which is a great cafe in Astoria.”

If La Guardia showed us that an outside the establishment, socialist mayor could transform New York City, Zohran Mamdani seems ready to show us that there is no reason it can’t work again. And millions of New York City residence are ready to embrace it. q

Congratulations! Job Well Done! Go Seals! Yeah Obama! You got Osama bin Laden!

Congratulations! Job Well Done! Go Seals! Yeah Obama! You got Osama bin Laden!